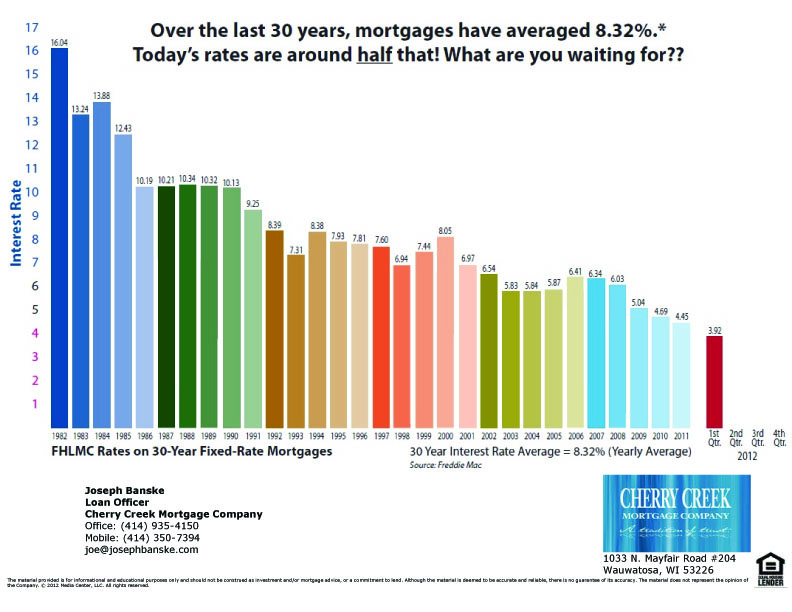

View rate chart as a larger pdf. Chart provided by Joseph Banske

Price of a home versus Cost of a home

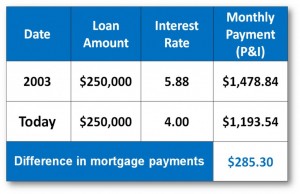

Every buyer wants to buy at a good price, but price is just part of the picture. If you’re getting a mortgage, the interest rate greatly affects the long term cost of owning a home. If rates go up, the same home could cost thousands of dollars more over the course of the mortgage loan. The savings below are MONTHLY savings, AND the interest rates are even lower than 4% right now.

chart from KCM blog

chart from KCM blog

Think long term

If you are in a position to buy, lucky you! Don’t be too concerned about a potential drop in the value of your home after you buy because long term owning has typically been a good investment. Make sure you are paying attention to the long term cost savings of buying when mortgage rates are at historic lows. Read more on this subject at the KCM Blog, contact one of our Wisconsin mortgage partners, or get in touch with a First Weber agent to discuss the affect mortgage rates have on the cost of homeowning.

Check out the great Wisconsin real estate values at firstweber.com and thank you for reading the First Weber Wisconsin real estate & Wisconsin living blog

credit http://creativecommons.org/licenses/by-nc-nd/2.0/deed.en