What is the Wisconsin Housing Affordability Index?

This number shows what percentage of a median priced home a buyer with a median family income could afford, assuming current mortgage rates and 20% down.

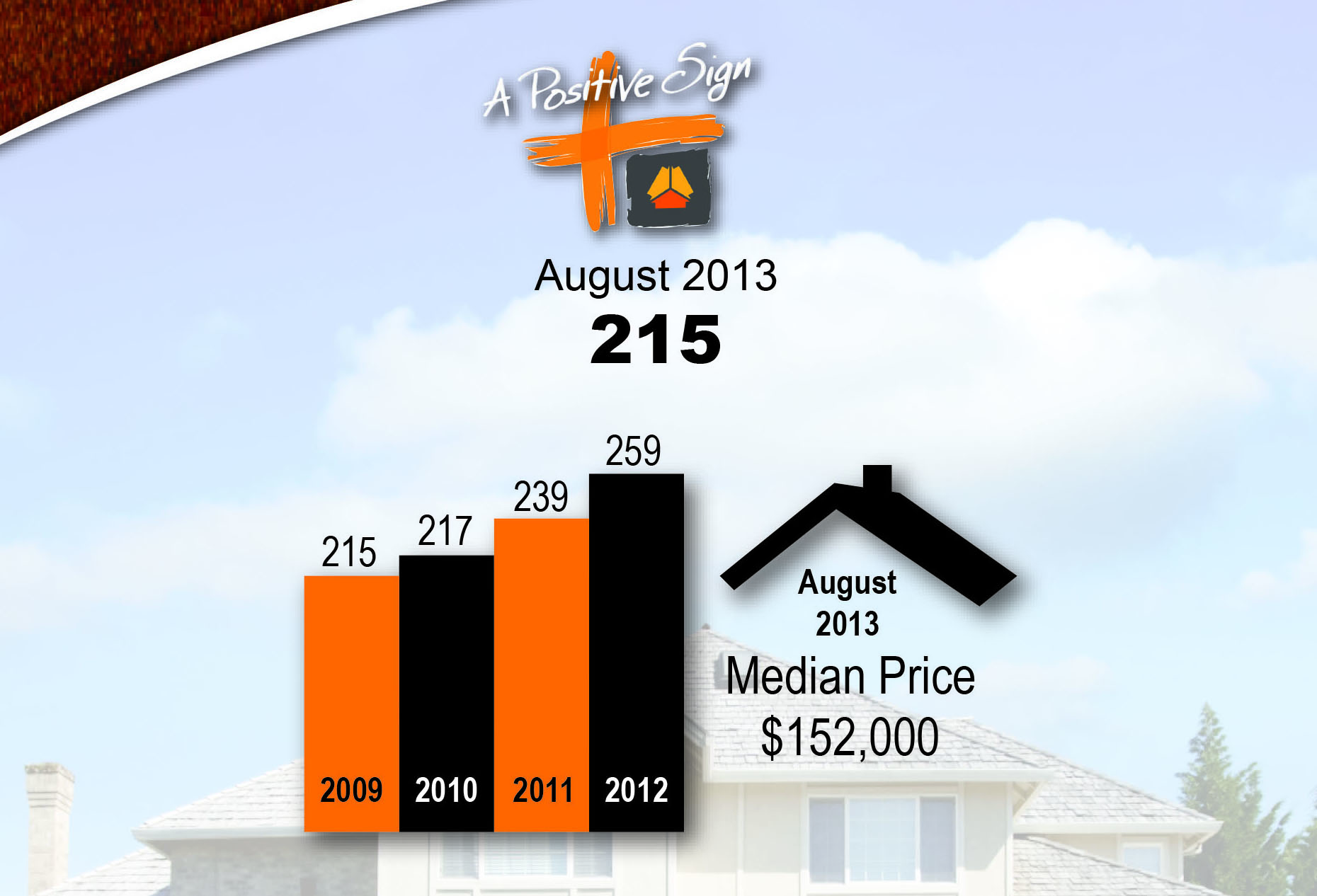

So, a typical buyer could afford 215% of a median priced home in Wisconsin.

While still very affordable, the Housing Affordability Index has gone down in recent months and from its peak in January, 2013 (292). Trends of rising prices will eventually lessen the affordability of real estate in Wisconsin. According to Michael Theo, WRA President and CEO, “Buyers should consider these trends and take advantage of the current market conditions.”

That goes for sellers who want to move up, too.

We are experiencing a lack of inventory of homes for sale which drives competition and urgency amongst buyers. If you have waited to sell your home and want to talk about activity and prices in your area of Wisconsin, contact your favorite First Weber real estate agent or contact First Weber.

Thanks for reading the First Weber Wisconsin real estate & Wisconsin living blog for information about housing affordability in Wisconsin.