For Sellers, Home Buyers

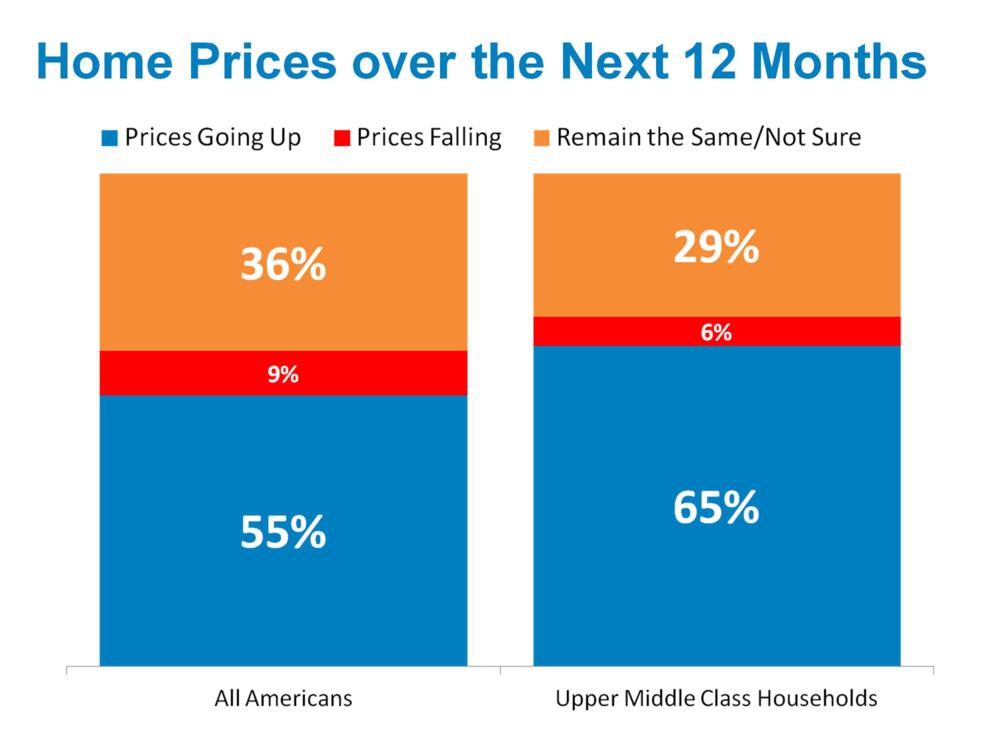

55% of all Americans expect home prices to rise over the next 12 months

Optimism all around This chart shows that a very small percentage of Americans expect home prices to fall in the next 12 months. By a good margin, continued increases are expected. This is good news to everyone with a hand in real estate – even homebuyers. Why homebuyers? The buyer’s market is gone and […]