Home Buyers

Lenders easing credit standards – making it easier for buyers to get into a home

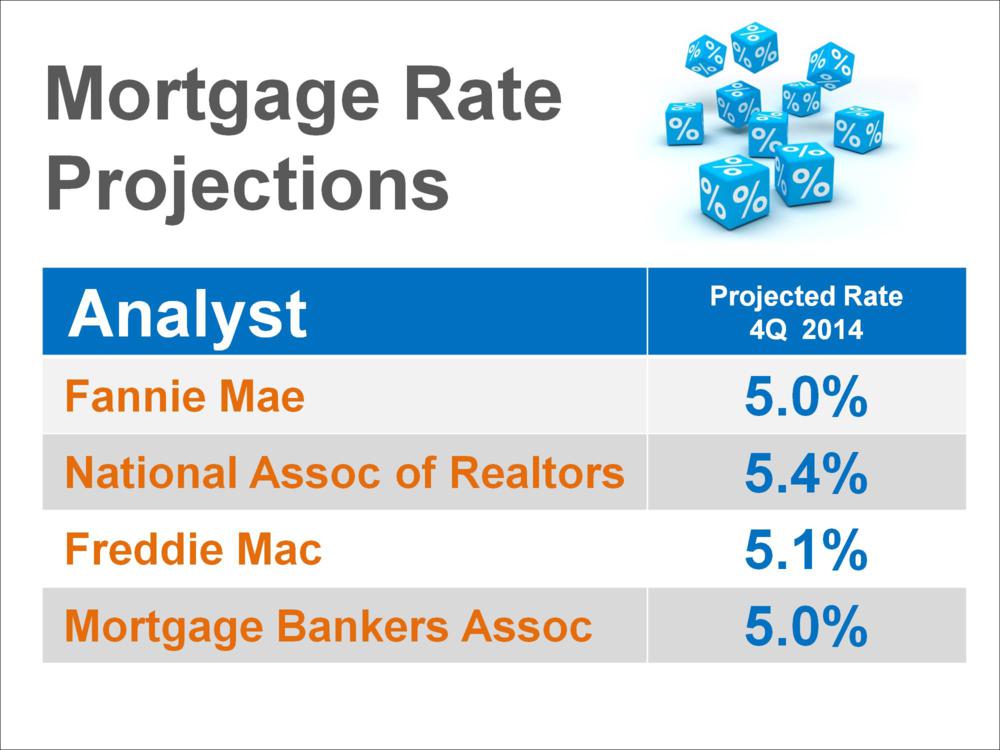

If you have buying a home on your to-do list for the new year, you’ll be happy to hear that lenders have been easing credit standards and plan to continue to do so. According to Fannie Mae’s fourth quarter 2015 Mortgage Lender Sentiment Survey, 16% of lenders plan on easing standards in order to help […]