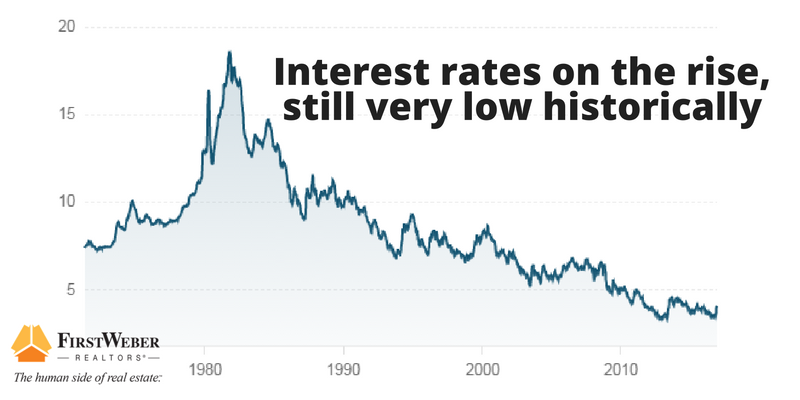

Interest rates fluctuate on an ongoing basis – from rates in the teens in the 1980s to the low single digit rates of today. Not only are they low, but they have remained low for actually a very long time. (Currently creeping upward…) Buyers need to know what an opportunity this is – and how much the interest rate of a mortgage affects their monthly housing cost and purchasing power. Locking in a low rate over a 30 year loan saves hundreds of dollars every month, tens of thousands or even more over the course of the loan.

Not only does the low rate save you money over time, it allows you more purchasing power – your money goes further.

For example, let’s say the buyer can afford around $1,000/month.

- In the year 2000 when rates were 8%, a mortgage payment of around $1,000 would purchase a home valued at approximately $134,000.

- In 2016 when rates are in the low 3-4% range, a mortgage payment of around $1,000 would purchase a home valued at approximately $225,000.

See what a difference mortgage rates make? And what a value buyers can lock in for a 30 year mortgage at such low rates. Get prequalified by a lender and get home shopping today. Rates have recently been creeping up – but still fantastically low. See?

First Weber sells real estate throughout Wisconsin: Metro Milwaukee and Southeastern WI, South Central Wisconsin/Greater Madison, Southwestern WI, Western WI & parts of Minnesota, Central Wisconsin, Northeast Wisconsin and Wisconsin’s great Northwoods. You can start searching for Wisconsin real estate and Wisconsin real estate agents at firstweber.com