Purchasing a home is one of the biggest financial moves you’ll make in your life so it is important to be prepared. The process can be a bit daunting especially if you are a first-time home buyer. This is why we have put together the process, key terms, and other tips for you to help eliminate overwhelming feelings.

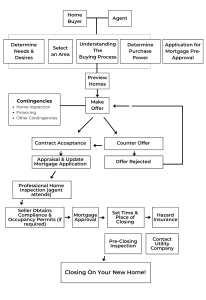

This chart breaks down the home-buying process for you

Buyers Guide

Understanding the steps in the home-buying process will help make the journey run more smoothly. Here is the process in broken down more simply.

Showing Process

Your agent will assist you in selecting homes for viewing that follow your wants and needs. Feel free to inspect all aspects of a home during this showing process and make notes regarding each home.

Communication During Showing

This is an important time to give your agent feedback. This is essential to help them determine exactly what you are looking for.

Mortgage Application

Your agent should recommend several lenders for you to contact. Understanding the mortgage process and the different first-time homebuyer loan options beforehand will help the process go faster. It is extremely important that you apply for a loan immediately after your offer is accepted. The lender may require a loan application fee to be used toward a credit check, appraisal, etc. so be prepared for that.

Processing your Loan

While your loan is being processed, your agent will be checking throughout that time to ensure things are progressing smoothly. Have your bank account and credit card numbers available as these will need to be verified by your lender.

Time and Place of Closing

Once your loan is approved, the time and place for the closing that was agreed upon in the offer will be scheduled.

What to be prepared with before your closing

- Have all utilities transferred to your name.

- Notify the post office and telephone company of your address change.

- Make a final inspection of the property.

- Decide if you want a one-year Home Warranty Plan.

- Your lender may require you to obtain a homeowner’s insurance policy and have a paid receipt to begin coverage on your new home at closing.

- Obtain a certified check for the exact amount of money to be paid at closing. You will know this figure before closing.

Other First Time Home Buying Tips

Don’t Skip the Home Inspection

During a home inspection, the inspector tells you about specific problems with the property. You can use the results of your inspection to learn more about your home and request concessions from your seller.

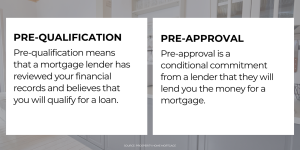

Get Pre-Qualified and Pre-Approved

Understand the difference between pre-qualification and pre-approval to know exactly how much house you can afford. Having these two done beforehand can give you leverage to make a stronger offer because the seller will already know you can afford the home. You will experience fewer surprises and be less likely to run into any last-minute delays with your mortgage lender.

Don’t Forget About Closing Costs

Don’t be surprised when there are more costs for you at your closing than just the down payment. Closing costs are upfront expenses that go to your lender in exchange for arranging certain loan services. Some common closing costs you may see are:

- Attorney fees

- Pet inspection fees

- Appraisal fees

- Escrow fees

- Homeowners Insurance

- Title insurance expenses

- Property taxes

Feeling overwhelmed yet? It’s OK! This is what Real Estate Agents are for! Speak to a First Weber agent today to get started and purchase your first home.

Sources: First Weber, Prosperity Home Mortgage, Rocket Mortgage

Founded in 1971, First Weber Realtors® is a part of HomeServices of America, the nation’s largest provider of total home services. With 60 offices and more than 1,400 real estate professionals, First Weber is consistently number one in Wisconsin for unit sales and real estate sales volume. You can start searching for Wisconsin real estate and Wisconsin real estate agents at firstweber.com