Home Buyers

12 reasons for homeownership

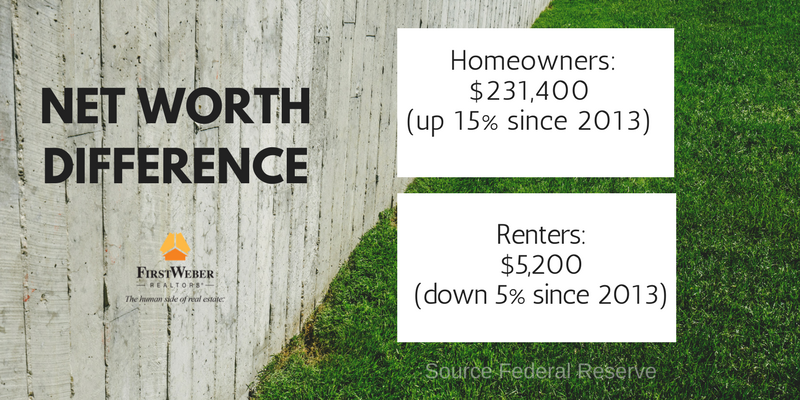

On the fence about buying a home? Not sure if it is right for you? If you are ready to settle down in one spot for a few years, have a steady job and are a disciplined saver, homeownership would be a great option for you. Here are 12 ways homeownership is beneficial to […]