For Sellers

Prices have rebounded. Time to sell?

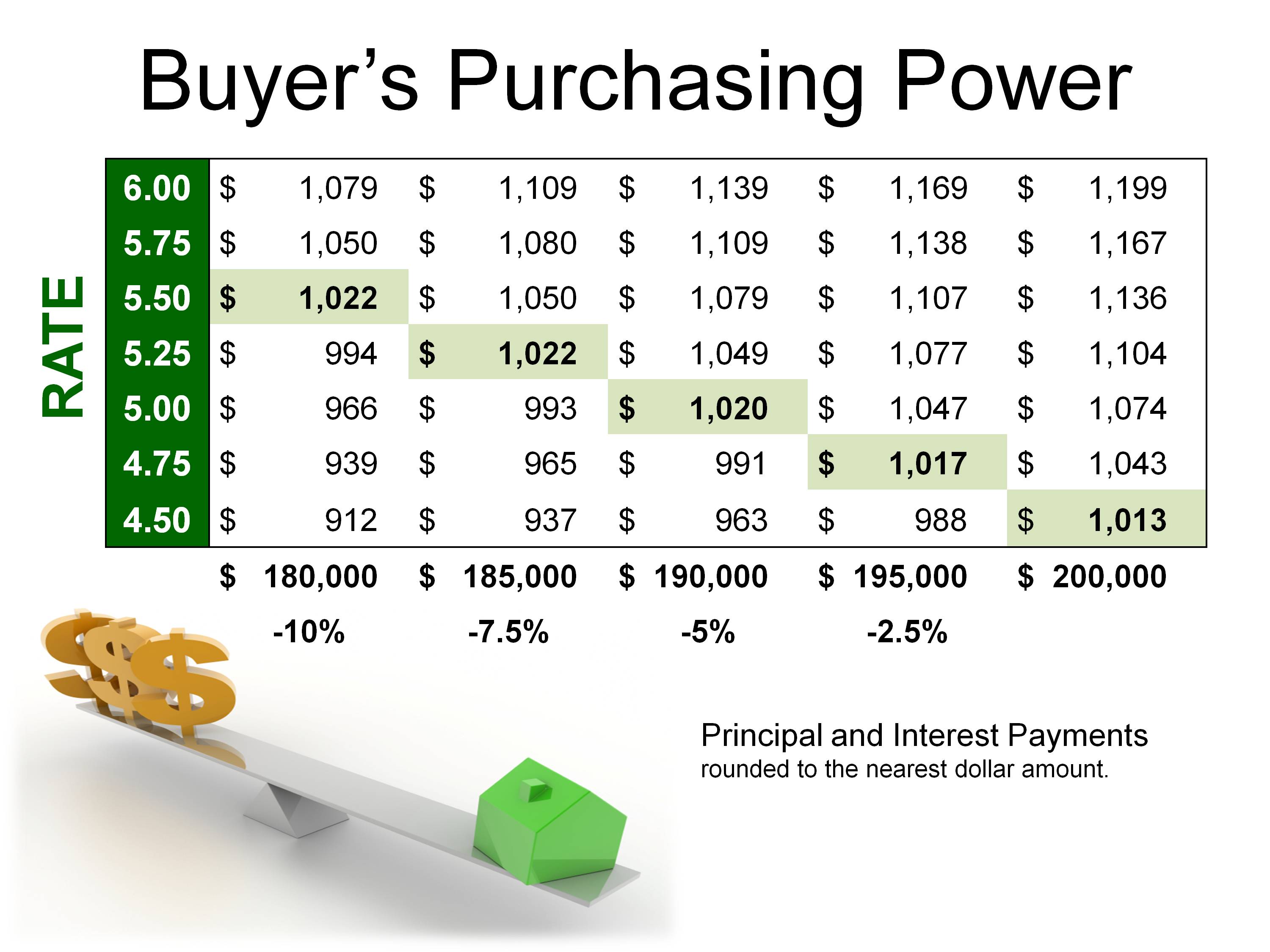

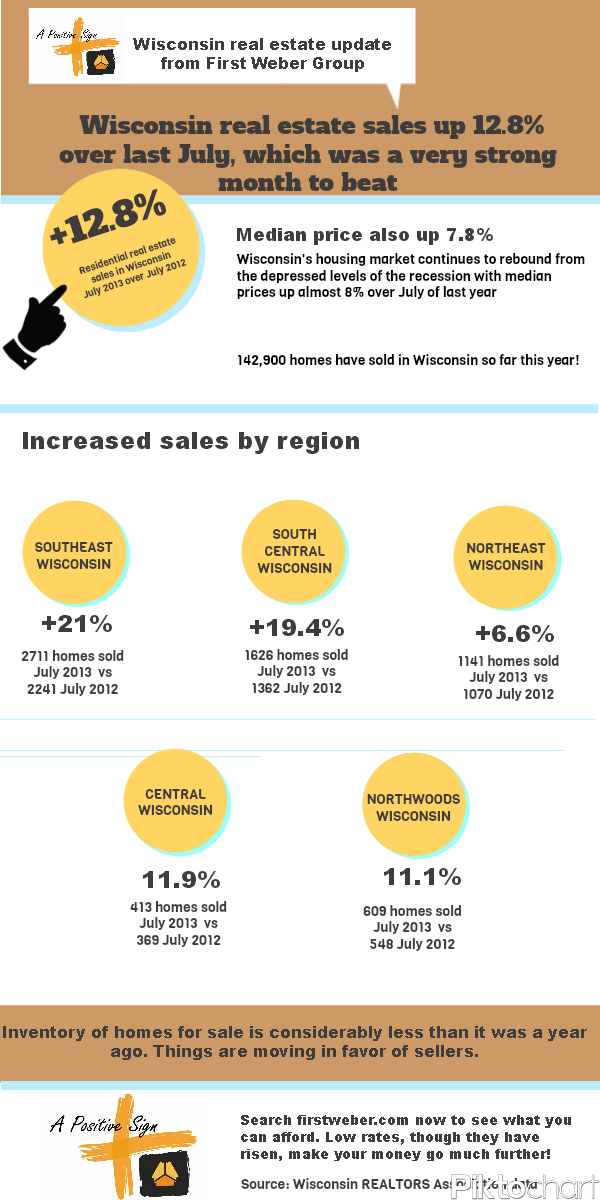

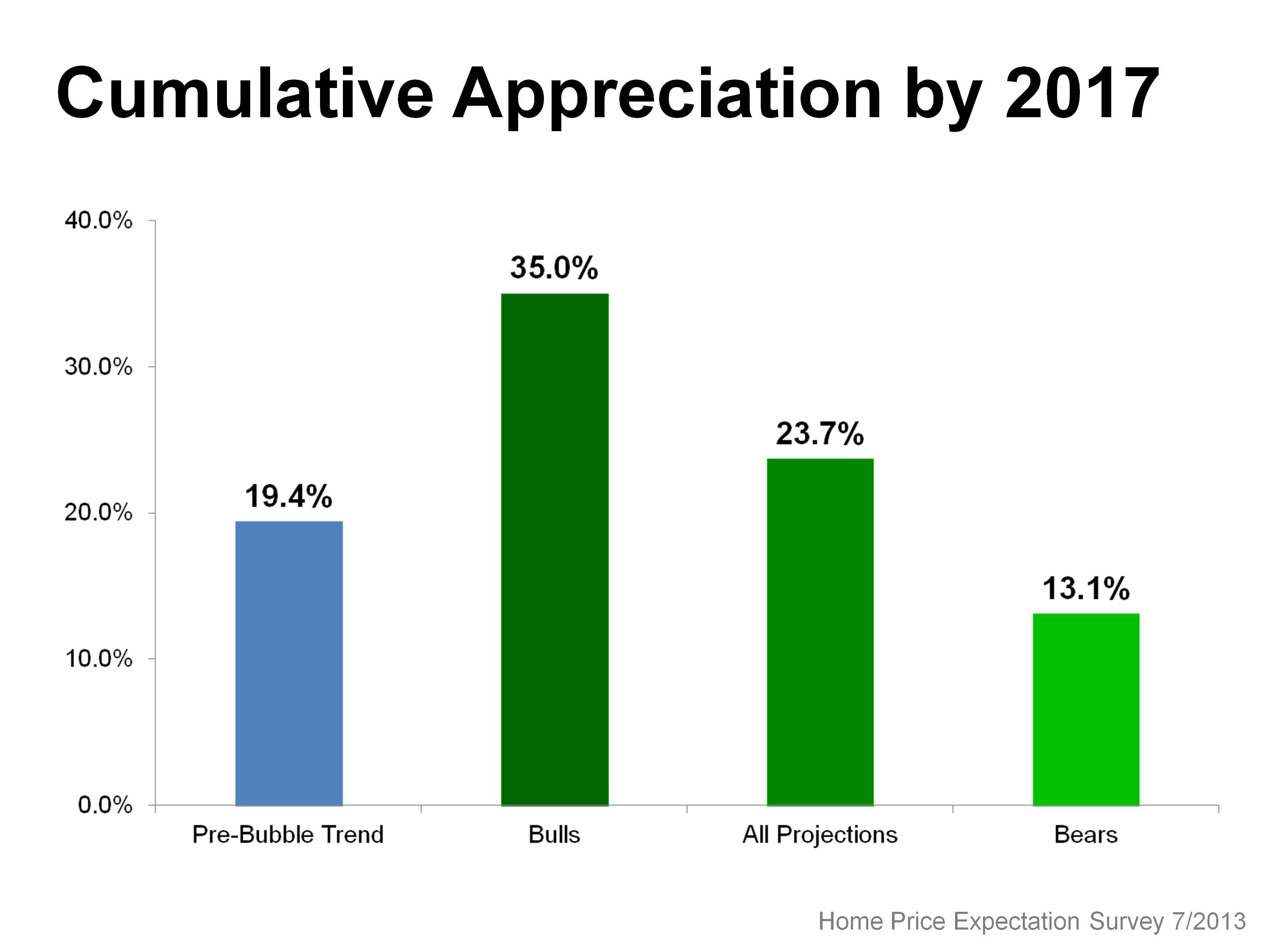

Prices have rebounded all over the country. Time to get back into the market to sell? Please contact First Weber Group for a consultation on the real estate market in your specific area of Wisconsin. You can also check out sold prices at firstweber.com on your own. This rising trend is expected to continue, […]