For Sellers, Home Buyers

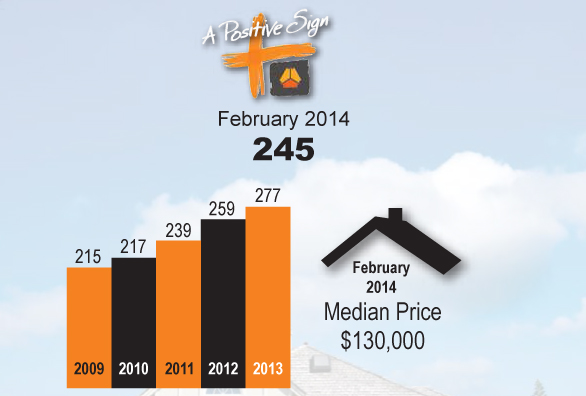

Wisconsin Housing Affordability Index still high.

What is the Wisconsin Housing Affordability Index? This number shows what percentage of a median priced home a buyer with a median family income could afford, assuming current mortgage rates and 20% down. So, a typical buyer could afford 245% of a median priced home in Wisconsin. While still very affordable, the Housing […]